REGULATIONS

(28:17 VA.R. April 23, 2012)

TABLE OF

CONTENTS

Publication

Schedule and Deadlines

Notices

of Intended Regulatory Action

Regulations

1VAC20-70.

Absentee Voting (Notice of Effective Date)

9VAC5-150.

Regulation for Transportation Conformity (Rev. G11) (Fast-Track)

9VAC5-200.

National Low Emission Vehicle Program (Rev. M11) (Fast-Track)

9VAC5-240.

Variance for Open Burning (Rev. I11) (Final)

9VAC5-500.

Exclusionary General Permit for Federal Operating Permit Program (Rev. H11)

(Fast-Track)

14VAC5-41.

Rules Governing Advertisement of Life Insurance and Annuities (Proposed)

14VAC5-300.

Rules Governing Credit for Reinsurance (Proposed)

The Virginia Register OF

REGULATIONS is an official state publication issued every other week

throughout the year. Indexes are published quarterly, and are cumulative for

the year. The Virginia Register has

several functions. The new and amended sections of regulations, both as

proposed and as finally adopted, are required by law to be published in the Virginia Register. In addition, the Virginia Register is a source of other

information about state government, including petitions for rulemaking,

emergency regulations, executive orders issued by the Governor, and notices of

public hearings on regulations.

ADOPTION, AMENDMENT, AND REPEAL OF REGULATIONS

An agency

wishing to adopt, amend, or repeal regulations must first publish in the Virginia Register a notice of intended

regulatory action; a basis, purpose, substance and issues statement; an

economic impact analysis prepared by the Department of Planning and Budget; the

agency’s response to the economic impact analysis; a summary; a notice giving

the public an opportunity to comment on the proposal; and the text of the

proposed regulation.

Following

publication of the proposal in the Virginia Register, the promulgating agency

receives public comments for a minimum of 60 days. The Governor reviews the

proposed regulation to determine if it is necessary to protect the public

health, safety and welfare, and if it is clearly written and easily

understandable. If the Governor chooses to comment on the proposed regulation,

his comments must be transmitted to the agency and the Registrar no later than

15 days following the completion of the 60-day public comment period. The

Governor’s comments, if any, will be published in the Virginia Register. Not less than 15 days following the completion

of the 60-day public comment period, the agency may adopt the proposed

regulation.

The

Joint Commission on Administrative Rules (JCAR) or the appropriate standing

committee of each house of the General Assembly may meet during the

promulgation or final adoption process and file an objection with the Registrar

and the promulgating agency. The objection will be published in the Virginia Register. Within 21 days after

receipt by the agency of a legislative objection, the agency shall file a

response with the Registrar, the objecting legislative body, and the Governor.

When

final action is taken, the agency again publishes the text of the regulation as

adopted, highlighting all changes made to the proposed regulation and

explaining any substantial changes made since publication of the proposal. A

30-day final adoption period begins upon final publication in the Virginia Register.

The

Governor may review the final regulation during this time and, if he objects,

forward his objection to the Registrar and the agency. In addition to or in

lieu of filing a formal objection, the Governor may suspend the effective date

of a portion or all of a regulation until the end of the next regular General

Assembly session by issuing a directive signed by a majority of the members of

the appropriate legislative body and the Governor. The Governor’s objection or

suspension of the regulation, or both, will be published in the Virginia Register. If the Governor finds

that changes made to the proposed regulation have substantial impact, he may

require the agency to provide an additional 30-day public comment period on the

changes. Notice of the additional public comment period required by the

Governor will be published in the Virginia

Register.

The

agency shall suspend the regulatory process for 30 days when it receives

requests from 25 or more individuals to solicit additional public comment,

unless the agency determines that the changes have minor or inconsequential

impact.

A

regulation becomes effective at the conclusion of the 30-day final adoption

period, or at any other later date specified by the promulgating agency, unless

(i) a legislative objection has been filed, in which event the regulation,

unless withdrawn, becomes effective on the date specified, which shall be after

the expiration of the 21-day objection period; (ii) the Governor exercises his

authority to require the agency to provide for additional public comment, in

which event the regulation, unless withdrawn, becomes effective on the date

specified, which shall be after the expiration of the period for which the

Governor has provided for additional public comment; (iii) the Governor and the

General Assembly exercise their authority to suspend the effective date of a

regulation until the end of the next regular legislative session; or (iv) the

agency suspends the regulatory process, in which event the regulation, unless

withdrawn, becomes effective on the date specified, which shall be after the expiration

of the 30-day public comment period and no earlier than 15 days from

publication of the readopted action.

A

regulatory action may be withdrawn by the promulgating agency at any time

before the regulation becomes final.

FAST-TRACK RULEMAKING PROCESS

Section

2.2-4012.1 of the Code of Virginia provides an exemption from certain

provisions of the Administrative Process Act for agency regulations deemed by

the Governor to be noncontroversial. To

use this process, Governor's concurrence is required and advance notice must be

provided to certain legislative committees.

Fast-track regulations will become effective on the date noted in the

regulatory action if no objections to using the process are filed in accordance

with § 2.2-4012.1.

EMERGENCY REGULATIONS

Pursuant

to § 2.2-4011

of the Code of Virginia, an agency, upon consultation with the Attorney

General, and at the discretion of the Governor, may adopt emergency regulations

that are necessitated by an emergency situation. An agency may also adopt an

emergency regulation when Virginia statutory law or the appropriation act or

federal law or federal regulation requires that a regulation be effective in

280 days or less from its enactment. The

emergency regulation becomes operative upon its adoption and filing with the

Registrar of Regulations, unless a later date is specified. Emergency

regulations are limited to no more than 12 months in duration; however, may be

extended for six months under certain circumstances as provided for in

§ 2.2-4011 D. Emergency regulations are published as soon as possible in

the Register.

During

the time the emergency status is in effect, the agency may proceed with the

adoption of permanent regulations through the usual procedures. To begin

promulgating the replacement regulation, the agency must (i) file the Notice of

Intended Regulatory Action with the Registrar within 60 days of the effective

date of the emergency regulation and (ii) file the proposed regulation with the

Registrar within 180 days of the effective date of the emergency regulation. If

the agency chooses not to adopt the regulations, the emergency status ends when

the prescribed time limit expires.

STATEMENT

The

foregoing constitutes a generalized statement of the procedures to be followed.

For specific statutory language, it is suggested that Article 2 (§ 2.2-4006

et seq.) of Chapter 40 of Title 2.2 of the Code of Virginia be examined

carefully.

CITATION TO THE VIRGINIA

REGISTER

The Virginia Register is cited by volume,

issue, page number, and date. 28:2 VA.R.

47-141 September 26, 2011, refers to Volume 28, Issue 2, pages 47 through 141

of the Virginia Register issued on

September 26, 2011.

The Virginia Register of Regulations is published pursuant to Article 6 (§ 2.2-4031 et

seq.) of Chapter 40 of Title 2.2 of the Code of Virginia.

Members

of the Virginia Code Commission: John S. Edwards, Chairman; Gregory D. Habeeb; James M. LeMunyon; Ryan T. McDougle; Robert L.

Calhoun; E.M. Miller, Jr.; Thomas M. Moncure, Jr.; Wesley G. Russell, Jr.;

Charles S. Sharp; Robert L. Tavenner; Patricia L. West; J. Jasen Eige or

Jeffrey S. Palmore.

Staff

of the Virginia Register: Jane D.

Chaffin, Registrar of Regulations; June T. Chandler, Assistant Registrar.

|

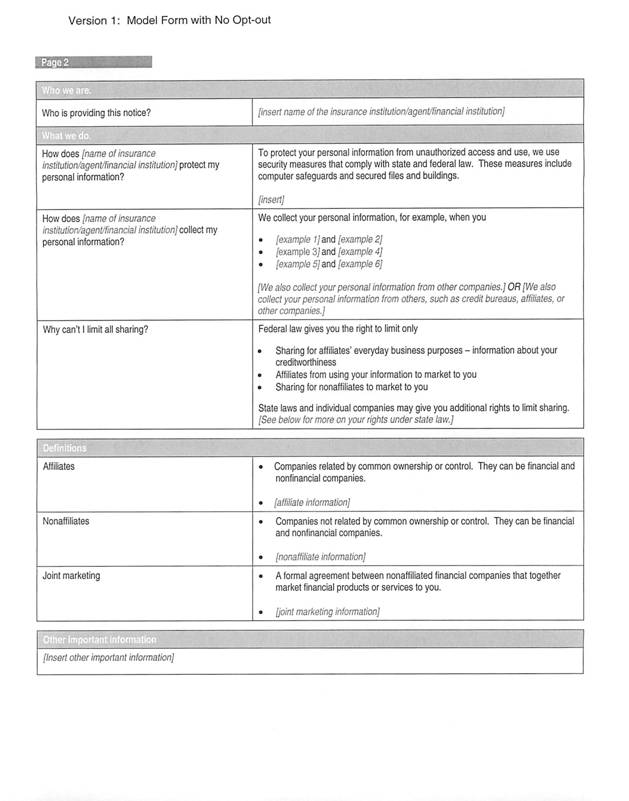

Volume: Issue |

Material Submitted By Noon* |

Will Be Published On |

|

28:17 |

April 4, 2012 |

April 23, 2012 |

|

28:18 |

April 18, 2012 |

May 7, 2012 |

|

28:19 |

May 2, 2012 |

May 21, 2012 |

|

28:20 |

May 16, 2012 |

June 4, 2012 |

|

28:21 |

May 30, 2012 |

June 18, 2012 |

|

28:22 |

June 13, 2012 |

July 2, 2012 |

|

28:23 |

June 27, 2012 |

July 16, 2012 |

|

28:24 |

July 11, 2012 |

July 30, 2012 |

|

28:25 |

July 25, 2012 |

August 13, 2012 |

|

28:26 |

August 8, 2012 |

August 27, 2012 |

|

29:1 |

August 22, 2012 |

September 10, 2012 |

|

29:2 |

September 5, 2012 |

September 24, 2012 |

|

29:3 |

September 19, 2012 |

October 8, 2012 |

|

29:4 |

October 3, 2012 |

October 22, 2012 |

|

29:5 |

October 17, 2012 |

November 5, 2012 |

|

29:6 |

October 31, 2012 |

November 19, 2012 |

|

29:7 |

November 13, 2012 (Tuesday) |

December 3, 2012 |

|

29:8 |

November 28, 2012 |

December 17, 2012 |

|

29:9 |

December 11, 2012 (Tuesday) |

December 31, 2012 |

|

29:10 |

December 26, 2012 |

January 14, 2013 |

|

29:11 |

January 9, 2013 |

January 28, 2013 |

|

29:12 |

January 23, 2013 |

February 11, 2013 |

|

29:13 |

February 6, 2013 |

February 25, 2013 |

|

29:14 |

February 20, 2013 |

March 11, 2013 |

|

29:150 |

March 6, 2013 |

March 25, 2013 |

|

29:16 |

March 20, 2013 |

April 8, 2013 |

|

29:17 |

April 3, 2013 |

April 22, 2013 |

*Filing deadlines are Wednesdays unless otherwise specified.

TITLE 18. PROFESSIONAL AND OCCUPATIONAL LICENSING

BOARD OF DENTISTRY

Initial Agency Notice

Title of Regulation: 18VAC60-20. Regulations

Governing Dental Practice.

Statutory Authority: § 54.1-2400 of the Code of Virginia.

Name of Petitioner: Denice Burnette.

Nature of Petitioner's Request: Amend 18VAC60-20-190 to permit dental assistants II to operate a high speed rotary instrument in the mouth.

Agency's Plan for Disposition of Request: The petition will be posted and sent for public comment ending May 18, 2012. The Board of Dentistry will consider the petition and any comment at its meeting scheduled for June 8, 2012.

Public Comment Deadline: May 18, 2012.

Agency Contact: Elaine J. Yeatts, Agency Regulatory Coordinator, Department of Health Professions, 9960 Mayland Drive, Suite 300, Richmond, VA 23233, telephone (804) 367-4688, or email elaine.yeatts@dhp.virginia.gov.

VA.R. Doc. No. R12-20; Filed April 3, 2012, 9:20 a.m.

STATE WATER CONTROL BOARD

Notice of Intended Regulatory Action

Notice is hereby given in accordance with § 2.2-4007.01 of the Code of Virginia that the State Water Control Board intends to consider amending 9VAC25-800, Virginia Pollutant Discharge Elimination System (VPDES) General Permit for Discharges Resulting From the Application of Pesticides to Surface Waters. The purpose of the proposed action is to amend and reissue a VPDES general permit for discharges from pesticides applied directly to surface waters to control pests, or applied to control pests that are present in or over, including near, surface waters. This permit expires on December 31, 2013, and needs to be reissued so pesticide operators can continue to have coverage to apply chemical pesticides that leave a residue in water and all biological pesticide applications that are made in or over, including near, waters of the United States. This regulatory action is also needed to incorporate appropriate changes from the federal National Pollutant Discharge Elimination System Pesticide General Permit.

The agency intends to hold a public hearing on the proposed action after publication in the Virginia Register.

Statutory Authority: § 62.1-44.15 of the Code of Virginia.

Public Comment Deadline: May 23, 2012.

Agency Contact: William K. Norris, Department of Environmental Quality, 629 East Main Street, P.O. Box 1105, Richmond, VA 23218, telephone (804) 698-4022, FAX (804) 698-4347, or email william.norris@deq.virginia.gov.

VA.R. Doc. No. R12-3168; Filed April 2, 2012, 2:05 p.m.

w –––––––––––––––––– w

TITLE 12. HEALTH

STATE BOARD OF HEALTH

Withdrawal of Notice of Intended Regulatory Action

The State Board of Health has WITHDRAWN the Notice of Intended Regulatory Action for 12VAC5-71, Regulations Governing Virginia Newborn Screening Services, which was published in 27:24 VA.R. 2579 August 1, 2011. This action is being withdrawn because the agency will be initiating a regulatory action using the fast-track rulemaking process (§ 2.2-4012.1 of the Code of Virginia) for this purpose.

Agency Contact: Susan Tlusty, Division of Child and Adolescent Health, Department of Health, 109 Governor Street, Richmond, VA 23219, telephone (804) 864-7686, FAX (804) 864-7647, or email susan.tlusty@vdh.virginia.gov.

VA.R. Doc. No. R11-2916; Filed March 26, 2012, 2:12 p.m.

Withdrawal of Notice of Intended Regulatory Action

Notice is hereby given in accordance with § 2.2-4007.01 of the Code of Virginia that the State Board of Health has WITHDRAWN the Notice of Intended Regulatory Action for 12VAC5-590, Waterworks Regulations, which was published in 28:8 VA.R. 668 December 19, 2011. The action is being withdrawn as the Virginia Department of Health has no clear indication that bonding for small waterworks can be accomplished through normal financial institutions and there is lack of affirmative support for such a regulation.

Agency Contact: Cathy Hanchey, Department of Health, Office of Drinking Water, 109 Governor Street, Richmond, VA, telephone (804) 864-7506, or email cathy.hanchey@vdh.virginia.gov.

VA.R. Doc. No. R12-3036; Filed March 26, 2012, 2:02 p.m.

w –––––––––––––––––– w

TITLE 13. HOUSING

BOARD OF HOUSING AND COMMUNITY DEVELOPMENT

Notice of Intended Regulatory Action

Notice is hereby given in accordance with § 2.2-4007.01 of the Code of Virginia that the Board of Housing and Community Development intends to consider amending 13VAC5-31, Virginia Amusement Device Regulations. The purpose of the proposed action is to update the regulation to incorporate by reference the newest available nationally recognized codes and standards. The standards for amusement devices are controlled by the American Society for Testing and Materials (ASTM). In conjunction with incorporating the newest available standards into the regulation, the entire regulation will be subject to review and change. The ASTM standards constitute the majority of the regulation and the various parts of the regulation must be coordinated with the use of those standards, which necessitates scrutiny of the entire regulation.

This action is exempt from Article 2 of the Administrative Process Act under § 2.2-4406 A 12 of the Code of Virginia.

The agency intends to hold a public hearing on the proposed action after publication in the Virginia Register.

Statutory Authority: § 36-98.3 of the Code of Virginia.

Public Comment Deadline: May 23, 2012.

Agency Contact: Stephen W. Calhoun, Regulatory Coordinator, Department of Housing and Community Development, Main Street Center, 600 East Main Street, Suite 300, Richmond, VA 23219, telephone (804) 371-7000, FAX (804) 371-7090, TTY (804) 371-7089, or email steve.calhoun@dhcd.virginia.gov.

VA.R. Doc. No. R12-3160; Filed March 22, 2012, 4:34 p.m.

Notice of Intended Regulatory Action

Notice is hereby given in accordance with § 2.2-4007.01 of the Code of Virginia that the Board of Housing and Community Development intends to consider amending 13VAC5-51, Virginia Statewide Fire Prevention Code. The purpose of the proposed action is to update the regulation to incorporate by reference the newest available nationally recognized model building codes and standards produced by International Code Council (ICC). The ICC International Fire Code (IFC) is the major model code. The IFC further references the ICC building, mechanical, plumbing, gas, and electrical codes. The ICC codes are known collectively as the "I-Codes." In conjunction with incorporating the newest available I-Codes into the regulation, the entire regulation will be subject to review and change. The I-Codes constitute the majority of the regulation and the various parts of the regulation must be coordinated with the use of the I-Codes, which necessitates scrutiny of the entire regulation.

This action is exempt from Article 2 of the Administrative Process Act under § 2.2-4406 A 12 of the Code of Virginia.

The agency intends to hold a public hearing on the proposed action after publication in the Virginia Register.

Statutory Authority: § 27-97 of the Code of Virginia.

Public Comment Deadline: May 23, 2012.

Agency Contact: Stephen W. Calhoun, Regulatory Coordinator, Department of Housing and Community Development, Main Street Center, 600 East Main Street, Suite 300, Richmond, VA 23219, telephone (804) 371-7000, FAX (804) 371-7090, TTY (804) 371-7089, or email steve.calhoun@dhcd.virginia.gov.

VA.R. Doc. No. R12-3161; Filed March 22, 2012, 4:34 p.m.

Notice of Intended Regulatory Action

Notice is hereby given in accordance with § 2.2-4007.01 of the Code of Virginia that the Board of Housing and Community Development intends to consider amending 13VAC5-63, Virginia Uniform Statewide Building Code. The purpose of the proposed action is to update the regulation to incorporate by reference the newest available nationally recognized model building codes and standards produced by the International Code Council (ICC). The ICC International Building Code (IBC), the ICC International Existing Building Code, the International Residential Code and the International Property Maintenance Code are the major model codes. The IBC further references the ICC mechanical, plumbing, and gas codes and the National Electrical Code. The ICC codes are known collectively as the "I-Codes." In conjunction with incorporating the newest available I-Codes into the regulation, the entire regulation will be subject to review and change. The I-Codes constitute the majority of the regulation and the various parts of the regulation must be coordinated with the use of the I-Codes, which necessitates scrutiny of the entire regulation.

This action is exempt from Article 2 of the Administrative Process Act under § 2.2-4406 A 12 of the Code of Virginia.

The agency intends to hold a public hearing on the proposed action after publication in the Virginia Register.

Statutory Authority: § 36-98 of the Code of Virginia.

Public Comment Deadline: May 23, 2012.

Agency Contact: Stephen W. Calhoun, Regulatory Coordinator, Department of Housing and Community Development, Main Street Center, 600 East Main Street, Suite 300, Richmond, VA 23219, telephone (804) 371-7000, FAX (804) 371-7090, TTY (804) 371-7089, or email steve.calhoun@dhcd.virginia.gov.

VA.R. Doc. No. R12-3159; Filed March 22, 2012, 4:33 p.m.

Notice of Intended Regulatory Action

Notice is hereby given in accordance with § 2.2-4007.01 of the Code of Virginia that the Board of Housing and Community Development intends to consider amending 13VAC5-91, Virginia Industrialized Building Safety Regulations. The purpose of the proposed action is to update the regulation to incorporate by reference the newest available nationally recognized model building codes and standards produced by International Code Council (ICC). The ICC International Building Code (IBC), the ICC International Existing Building Code, the International Residential Code and the International Property Maintenance Code are the major model codes. The IBC further references the ICC mechanical, plumbing, gas, and electrical codes. The ICC codes are known collectively as the "I-Codes." In conjunction with incorporating the newest available I-Codes into the regulation, the entire regulation will be subject to review and change. The I-Codes constitute the majority of the regulation and the various parts of the regulation must be coordinated with the use of the I-Codes, which necessitates scrutiny of the entire regulation.

This action is exempt from Article 2 of the Administrative Process Act under § 2.2-4406 A 12 of the Code of Virginia.

The agency intends to hold a public hearing on the proposed action after publication in the Virginia Register.

Statutory Authority: § 36-73 of the Code of Virginia.

Public Comment Deadline: May 23, 2012.

Agency Contact: Stephen W. Calhoun, Regulatory Coordinator, Department of Housing and Community Development, Main Street Center, 600 East Main Street, Suite 300, Richmond, VA 23219, telephone (804) 371-7000, FAX (804) 371-7090, TTY (804) 371-7089, or email steve.calhoun@dhcd.virginia.gov.

VA.R. Doc. No. R12-3162; Filed March 22, 2012, 4:35 p.m.

w –––––––––––––––––– w

TITLE 18. PROFESSIONAL AND OCCUPATIONAL LICENSING

VIRGINIA BOARD FOR ASBESTOS, LEAD, MOLD, AND HOME INSPECTORS

Notice of Intended Regulatory Action

Notice is hereby given in accordance with § 2.2-4007.01 of the Code of Virginia that the Virginia Board for Asbestos, Lead, Mold, and Home Inspectors intends to consider amending 18VAC15-20, Virginia Asbestos Licensing Regulations. The purpose of the proposed action is to adjust licensing fees for regulants of the Board for Asbestos, Lead, Mold, and Home Inspectors. The board must establish fees adequate to support the costs of the board's operations and a proportionate share of the Department of Professional and Occupational Regulation's operations. By the close of the next biennium, fees will not provide adequate revenue for those costs. The board has no other source of revenue from which to fund its operations.

The agency intends to hold a public hearing on the proposed action after publication in the Virginia Register.

Statutory Authority: § 54.1-501 of the Code of Virginia.

Public Comment Deadline: May 23, 2012.

Agency Contact: David Dick, Executive Director, Virginia Board for Asbestos, Lead, Mold, and Home Inspectors, 9960 Mayland Drive, Suite 400, Richmond, VA 23233, telephone (804) 367-8595, FAX (804) 527-4297, or email alhi@dpor.virginia.gov.

VA.R. Doc. No. R12-3169; Filed April 3, 2012, 8:56 a.m.

BOARD OF NURSING

Withdrawal of Notice of Intended Regulatory Action

Notice is hereby given in accordance with § 2.2-4007.01 of the Code of Virginia that the Board of Nursing has WITHDRAWN the Notice of Intended Regulatory Action for 18VAC90-20, Regulations Governing the Practice of Nursing, which was published in 28:8 VA.R. 668 December 19, 2011. After review of the regulations for clinical nurse specialists by an ad hoc committee of board members and licensees, it was concluded that a change in the Code of Virginia is necessary to achieve the request of the petition for rulemaking that served as the basis for the notice.

Agency Contact: Jay P. Douglas, R.N., Executive Director, Board of Nursing, 9960 Mayland Drive, Suite 300, Richmond, VA 23233-1463, telephone (804) 367-4515, FAX (804) 527-4455, or email jay.douglas@dhp.virginia.gov.

VA.R. Doc. No. R11-28; Filed March 21, 2012, 8:41 a.m.

STATE BOARD OF ELECTIONS

Notice of Effective Date

Title of Regulation: 1VAC20-70. Absentee Voting (adding 1VAC20-70-20).

Statutory Authority: § 24.2-103 of the Code of Virginia.

Effective Date: April 3, 2012.

On January 23, 2012, the State Board of Elections adopted this regulation relating to material omissions from absentee ballots. The final regulation was published in Volume 28, Issue 12 of the February 13, 2012, edition of the Virginia Register (28:12 VA.R. 1012-1013 February 13, 2012) with an effective date upon filing a notice of the United States Attorney General's preclearance with the Registrar of Regulations. The State Board of Elections hereby notices the United States Attorney General's approval of this regulation via a letter dated March 27, 2012, from T. Christian Herren, Jr., Chief, Voting Section, to Joshua N. Lief, Esq., Senior Assistant Attorney General, Office of Attorney General of Virginia. The effective date of this regulation is April 3, 2012. Copies are available online at http://townhall.virginia.gov/L/ViewXML.cfm?textid=6183, by calling toll-free 1-800-552-9745, local (804) 864-8910, by sending a written request to FOIA Coordinator, 1100 Bank St., Richmond, VA 23219, or by email request to foia@sbe.virginia.gov.

Agency Contact: Justin Riemer, Deputy Secretary, State Board of Elections, 1100 Bank Street, Richmond, VA 23219, telephone (804) 864-8904, or email justin.riemer@sbe.virginia.gov.

VA.R. Doc. No. R11-2923; Filed April 3, 2012, 12:36 p.m.

w –––––––––––––––––– w

STATE AIR POLLUTION CONTROL BOARD

Fast-Track Regulation

Title of Regulation: 9VAC5-150. Regulation for Transportation Conformity (Rev. G11) (repealing 9VAC5-150-10 through 9VAC5-150-450).

Statutory Authority: § 10.1-1308 of the Code of Virginia.

Public Hearing Information: No public hearings are scheduled.

Public Comment Deadline: May 23, 2012.

Effective Date: June 7, 2012.

Agency Contact: Gary E. Graham, Department of Environmental Quality, 629 East Main Street, P.O. Box 1105, Richmond, VA 23218, telephone (804) 698-4103, FAX (804) 698-4510, or email gary.graham@deq.virginia.gov.

Basis: Section 10.1-1308 of the Virginia Air Pollution Control Law authorizes the State Air Pollution Control Board to promulgate regulations abating, controlling, and prohibiting air pollution to protect public health and welfare.

Section 176 of the federal Clean Air Act requires that transportation plans, programs, and projects that are funded or approved under Title 23 of the U.S. Code or the Federal Transit Act conform with state or federal air quality implementation plans.

40 CFR Part 51 Subpart T establishes the criteria and procedures governing the determination of conformity for all federally funded transportation plans, programs, and projects in nonattainment and maintenance areas for states with a federally approved SIP that establishes conformity criteria and procedures consistent with the transportation conformity regulation promulgated by EPA.

40 CFR Part 93 Subpart A establishes the criteria and procedures governing the determination of conformity for all federally funded transportation plans, programs, and projects in nonattainment and maintenance areas for states without an federally approved SIP revision that establishes conformity criteria and procedures consistent with the transportation conformity regulation promulgated by EPA.

Purpose: The purpose of a transportation conformity regulation is to establish criteria and procedures for the transportation planning organization to determine whether federally funded transportation plans, programs, and projects are in conformance with state plans for attaining and maintaining the health-based ambient air quality standards in the Northern Virginia, Richmond, and Hampton Roads areas. A transportation conformity regulation ensures that transportation activities will not produce new air quality violations, worsen existing violations, or delay timely attainment of the national ambient air quality standards.

9VAC5-150 was adopted on August 31, 1996, to meet the requirements of § 176 of the Clean Air Act and 40 CFR Part 51 Subpart T. However, EPA never approved this chapter, so all transportation conformity determinations continued to be made in accordance with the federal requirements of 40 CFR Part 93, Subpart A. In the absence of federal approval of Chapter 150, the board adopted a new Regulation for Transportation Conformity, Chapter 151 on March 26, 2007, which incorporated the requirements of 40 CFR Part 93, Subpart A. The new Chapter 151 became effective on May 31, 2007, and was approved by EPA on November 20, 2009 (74 FR 60194).

The requirements of 9VAC5-150 and 9VAC5-151 differ in many respects. Only 9VAC5-151 meets all of the federal statutory and regulatory requirements for transportation conformity and is therefore essential to protect the health and welfare of the public. In order for the state regulations to be administratively correct and for 9VAC5-151 to effectively and efficiently protect public health and welfare, 9VAC5-150 must be repealed.

Rationale for Using Fast-Track Process: 9VAC5-150 cannot be used for transportation conformity determinations because it lacks federal approval. There is an effective regulation for transportation conformity in 9VAC5-151 that has been federally approved. There is a very limited stakeholder group that is affected by transportation conformity regulations and the transportation conformity determination process under 9VAC5-151 has federal and state-specific stakeholder consultation provisions within the regulation. Therefore, no objections to the repeal of 9VAC5-150 are anticipated and the fast-track process is appropriate.

Substance: 9VAC5-150, Regulation for Transportation Conformity, is repealed in its entirety. The provisions of 9VAC5-151, Regulation for Transportation Conformity, are not affected by this action.

Issues: The primary advantage to the public is the removal of unusable and conflicting regulatory requirements, which improves the public's ability to understand and comply with regulatory requirements. There are no disadvantages to the public.

The primary advantage to the department is the removal of regulations that are no longer necessary. There are no disadvantages to the department.

Department of Planning and Budget's Economic Impact Analysis:

Summary of the Proposed Amendments to Regulation. The department proposes to repeal 9VAC5-150, Regulation for Transportation Conformity, in its entirety because a new Regulation for Transportation Conformity (9VAC5-151) has been adopted and supersedes this regulation.

Result of Analysis. The benefits likely exceed the costs for all proposed changes.

Estimated Economic Impact. Since 9VAC5-150 is superseded by 9VAC5-151, repealing the former will have no impact beyond reducing potential confusion amongst the public.

Businesses and Entities Affected. The proposed repealing of this regulation will not affect businesses or other entities.

Localities Particularly Affected. The proposed repealing of this regulation will not disproportionately affect particular localities.

Projected Impact on Employment. The proposed repealing of this regulation will not affect employment.

Effects on the Use and Value of Private Property. The proposed repealing of this regulation will not affect the use and value of private property.

Small Businesses: Costs and Other Effects. The proposed repealing of this regulation will not affect small businesses.

Small Businesses: Alternative Method that Minimizes Adverse Impact. The proposed repealing of this regulation will not produce an adverse impact on small businesses.

Real Estate Development Costs. The proposed repealing of this regulation will not affect real estate development costs.

Legal Mandate. The Department of Planning and Budget (DPB) has analyzed the economic impact of this proposed regulation in accordance with § 2.2-4007.04 of the Administrative Process Act and Executive Order Number 14 (10). Section 2.2-4007.04 requires that such economic impact analyses include, but need not be limited to, the projected number of businesses or other entities to whom the regulation would apply, the identity of any localities and types of businesses or other entities particularly affected, the projected number of persons and employment positions to be affected, the projected costs to affected businesses or entities to implement or comply with the regulation, and the impact on the use and value of private property. Further, if the proposed regulation has adverse effect on small businesses, § 2.2-4007.04 requires that such economic impact analyses include (i) an identification and estimate of the number of small businesses subject to the regulation; (ii) the projected reporting, recordkeeping, and other administrative costs required for small businesses to comply with the regulation, including the type of professional skills necessary for preparing required reports and other documents; (iii) a statement of the probable effect of the regulation on affected small businesses; and (iv) a description of any less intrusive or less costly alternative methods of achieving the purpose of the regulation. The analysis presented above represents DPB's best estimate of these economic impacts.

Agency's Response to Economic Impact Analysis: The department has reviewed the economic impact analysis prepared by the Department of Planning and Budget and has no comment.

Summary:

This action repeals in its entirety 9VAC5-150, Regulation for Transportation Conformity, because a new regulation for transportation conformity (9VAC5-151) is in effect and is the only regulation that meets all state and federal statutory and regulatory requirements.

VA.R. Doc. No. R12-2930; Filed April 4, 2012, 10:15 a.m.

Title of Regulation: 9VAC5-200. National Low Emission Vehicle Program (Rev. M11) (repealing 9VAC5-200-10 through 9VAC5-200-30).

Statutory Authority: §§ 10.1-1308 and 46.2-1179.1 of the Code of Virginia.

Public Hearing Information: No public hearings are scheduled.

Public Comment Deadline: May 23, 2012.

Effective Date: June 7, 2012.

Agency Contact: Gary E. Graham, Department of Environmental Quality, 629 East Main Street, P.O. Box 1105, Richmond, VA 23218, telephone (804) 698-4103, FAX (804) 698-4510, or email gary.graham@deq.virginia.gov.

Basis: Section 10.1-1308 of the Code of Virginia authorizes the State Air Pollution Control Board to promulgate regulations abating, controlling, and prohibiting air pollution in order to protect public health and welfare.

Section 46.2-1179.1 of the Code of Virginia provides that the board may adopt clean alternative fuel fleet standards consistent with the federal Clean Air Act and that adoption by the board of an equivalent approval by EPA (such as the NLEV program) removes the authority for those clean alternative fuel fleet regulations.

Purpose: The purpose of the regulation for the National Low Emission Vehicle (NLEV) Program (9VAC5-200) was to require mobile source manufacturers to participate in the federal National Low Emission Vehicle Program (Subpart R, 40 CFR 86), which was a transitional program for the federal Tier 2 standards. 9VAC5-200 was adopted to meet that federal requirement. Subsequently, the requirements of the federal NLEV program were superseded with the February 10, 2000, promulgation of the federal Tier 2 standards which were more restrictive than the NLEV program standards (65 FR 6698). Therefore, a federal requirement to have a Virginia NLEV program in place no longer exists. Additionally, because 9VAC5-200 has no requirements that are applicable to new vehicles after the 2006 model year, there is no longer a need for the NLEV program regulation. This purpose of this amendment is to repeal 9VAC5-200, National Low Emission Vehicle Program, since it is no longer necessary to protect public health and welfare.

Rationale for Using Fast Track Process: 9VAC5-200 is no longer the most restrictive standard for low emission vehicles and is unusable for determining compliance with federal low emission vehicle standards. Additionally, there is a very limited stakeholder group (2 vehicle manufacturers) that could have been affected by this regulation. With the expiration of the program requirements with the 2006 model year, there are no remaining affected stakeholders that would have any objection to the repeal of this regulation. Therefore, no objections to the repeal of the 9VAC5-200 are anticipated.

Substance: 9VAC5-200, the regulation for the National Low Emission Vehicle Program, is repealed in its entirety.

Issues: The primary advantage to the public is the removal of unusable state regulatory requirements, which improves the public's ability to understand and comply with federal regulatory requirements. There are no disadvantages to the public.

The primary advantage to the department is the removal of regulations that are no longer necessary. There are no disadvantages to the department.

Department of Planning and Budget's Economic Impact Analysis:

Summary of the Proposed Amendments to Regulation. This regulation (9VAC5-200) for the National Low Emission Vehicle (NLEV) Program was adopted by the State Air Pollution Control Board (Board) on January 7, 1999 with an effective date of April 14, 1999, to implement an EPA-approved alternative clean fuel fleet standard for mobile sources. The regulation required mobile source manufacturers to participate in the federal National Low Emission Vehicle Program (40 CFR 86 Subpart R).

On February 10, 2000 the federal NLEV program was superseded by federal Tier 2 standards which were more restrictive than the NLEV program standards (65 FR 6698). Additionally, 9VAC5-200 has no requirements that are applicable to new vehicles after the 2006 model year. Thus the Board proposes to repeal this regulation in its entirety.

Result of Analysis. The benefits likely exceed the costs for all proposed changes.

Estimated Economic Impact. The current regulations do not effectively produce any requirements for manufacturers or any other entities since there are no requirements that are applicable to new vehicles after the 2006 model year and since in 2010 the federal NLEV program was superseded by federal Tier 2 standards which were more restrictive than the NLEV program standards. Thus repealing these regulations will have no impact beyond reducing potential confusion amongst the public.

Businesses and Entities Affected. Only new vehicle manufacturers were affected by this regulation. Such entities would not be affected by the repeal of this regulation since there are no requirements that are applicable to new vehicles after the 2006 model year and since in 2010 the federal NLEV program was superseded by federal Tier 2 standards which were more restrictive than the NLEV program standards.

Localities Particularly Affected. The proposed repeal of this regulation does not have a disproportionate effect on any particular localities.

Projected Impact on Employment. The proposed repeal of this regulation will not affect employment.

Effects on the Use and Value of Private Property. The proposed repeal of this regulation will not affect the use and value of private property.

Small Businesses: Costs and Other Effects. The proposed repeal of this regulation will not affect small businesses.

Small Businesses: Alternative Method that Minimizes Adverse Impact. The proposed repeal of this regulation will not affect small businesses.

Real Estate Development Costs. The proposed repeal of this regulation will not affect real estate development costs.

Legal Mandate. The Department of Planning and Budget (DPB) has analyzed the economic impact of this proposed regulation in accordance with § 2.2-4007.04 of the Administrative Process Act and Executive Order Number 14 (10). Section 2.2-4007.04 requires that such economic impact analyses include, but need not be limited to, the projected number of businesses or other entities to whom the regulation would apply, the identity of any localities and types of businesses or other entities particularly affected, the projected number of persons and employment positions to be affected, the projected costs to affected businesses or entities to implement or comply with the regulation, and the impact on the use and value of private property. Further, if the proposed regulation has adverse effect on small businesses, § 2.2-4007.04 requires that such economic impact analyses include (i) an identification and estimate of the number of small businesses subject to the regulation; (ii) the projected reporting, recordkeeping, and other administrative costs required for small businesses to comply with the regulation, including the type of professional skills necessary for preparing required reports and other documents; (iii) a statement of the probable effect of the regulation on affected small businesses; and (iv) a description of any less intrusive or less costly alternative methods of achieving the purpose of the regulation. The analysis presented above represents DPB's best estimate of these economic impacts.

Agency's Response to Economic Impact Analysis: The department has reviewed the economic impact analysis prepared by the Department of Planning and Budget and has no comment.

Summary:

This action repeals in its entirety 9VAC5-200, which was adopted to implement the federal National Low Emission Vehicle Program (NLEV). 9VAC5-200 is obsolete because the NLEV program has been superseded by federal Tier 2 standards that are more restrictive than the NLEV and because it has no requirements applicable to new vehicles after the 2006 model year.

VA.R. Doc. No. R12-3004; Filed April 4, 2012, 10:11 a.m.

REGISTRAR'S NOTICE: The State Air Pollution Control Board is claiming exemptions from §§ 2.2-4007 through 2.2-4007.06, 2.2-4013, 2.2-4014, and 2.2-4015 of the Administrative Process Act. Sections 2.2-4007.07, 2.2-4013 E, 2.2-4014 D, and 2.2-4015 C of the Administrative Process Act provide that these sections shall not apply to the issuance by the State Air Pollution Control Board of variances to its regulations.

Title of Regulation: 9VAC5-221. Variance for Rocket Motor Test Operations at Atlantic Research Corporation Gainesville Facility (Rev. L11) (repealing 9VAC5-221-10 through 9VAC5-221-60).

Statutory Authority: §§ 10.1-1307 and 10.1-1308 of the Code of Virginia.

Effective Date: May 23, 2012.

Agency Contact: Mary E. Major, Department of Environmental Quality, 629 East Main Street, P.O. Box 1105, Richmond, VA 23218, telephone (804) 698-4423, FAX (804) 698-4510, or email mary.major@deq.virginia.gov.

Background: On September 30, 2002, the board issued a variance (9VAC5-221) to the Atlantic Research Corporation (ARC) rocket test facility. Due to the nature of the testing operations, ARC had no appropriate method by which it could demonstrate compliance with the board's opacity standards. The board, therefore, granted a variance for the testing facility that enabled ARC to demonstrate compliance through meeting a particulate matter standard as an alternative to the opacity standard. Because the facility was shut down in March 2007, the variance is no longer required. In order for the state regulations to be administratively correct, 9VAC5-221 must now be repealed.

Summary:

The action repeals the variance issued to the Atlantic Research Corporation rocket test facility. The variance is no longer required because the facility was shut down in March 2007.

VA.R. Doc. No. R12-3020; Filed March 27, 2012, 10:27 a.m.

REGISTRAR'S NOTICE: The State Air Pollution Control Board is claiming exemptions from §§ 2.2-4007 through 2.2-4007.06, 2.2-4013, 2.2-4014, and 2.2-4015 of the Administrative Process Act. Sections 2.2-4007.07, 2.2-4013 E, 2.2-4014 D, and 2.2-4015 C of the Administrative Process Act provide that these sections shall not apply to the issuance by the State Air Pollution Control Board of variances to its regulations.

Title of Regulation: 9VAC5-240. Variance for Open Burning (Rev. I11) (repealing 9VAC5-240-10 through 9VAC5-240-50).

Statutory Authority: § 10.1-1307 of the Code of Virginia.

Effective Date: May 23, 2012.

Agency Contact: Gary E. Graham, Department of Environmental Quality, 629 East Main Street, P.O. Box 1105, Richmond, VA 23218, telephone (804) 698-4103, FAX (804) 698-4510, or email gary.graham@deq.virginia.gov.

Summary:

This chapter originally created a variance to relieve Gloucester County residents from seasonal restrictions on open burning. The variance expired on December 31, 2008; therefore, this chapter is being repealed.

VA.R. Doc. No. R12-2933; Filed March 26, 2012, 4:04 p.m.

Title of Regulation: 9VAC5-500. Exclusionary General Permit for Federal Operating Permit Program (Rev. H11) (repealing 9VAC5-500-10 through 9VAC5-500-240).

Statutory Authority: § 10.1-1308 of the Code of Virginia.

Public Hearing Information: No public hearings are scheduled.

Public Comment Deadline: May 23, 2012.

Effective Date: June 7, 2012.

Agency Contact: Gary E. Graham, Department of Environmental Quality, 629 East Main Street, P.O. Box 1105, Richmond, VA 23218, telephone (804) 698-4103, FAX (804) 698-4510, or email gary.graham@deq.virginia.gov.

Basis: Section 10.1-1308 of the Code of Virginia authorizes the State Air Pollution Control Board to promulgate regulations abating, controlling, and prohibiting air pollution to protect public health and welfare.

Purpose: Federal operating permit requirements mandated by Title V of the Clean Air Act and implemented in 9VAC5-80 largely apply only to sources with emissions that exceed specified levels and are thus major. To determine whether a source is major, not only are a source's actual emissions considered, but also its potential emissions. Thus, a source that has maintained actual emissions at levels below the major source threshold could still be subject to major source requirements if it has the potential to emit major amounts of air pollutants. However, such sources could legally avoid program requirements by taking federally-enforceable permit conditions that limit emissions to levels below the applicable major source threshold.

As the deadlines for complying with the Title V operating permit requirements approached, industry and state and local air pollution agencies became increasingly focused on the need to adopt and implement federally-enforceable mechanisms to limit emissions from sources that desire to limit potential emissions to below major source levels. In the case of Virginia, the board adopted a state operating permit program (9VAC5-80, Article 5) that was approved by the Environmental Protection Agency (EPA) for this purpose, but implementation of that program became problematic due to the volume of sources affected.

The EPA remained concerned that even with expedited approvals and other strategies, sources might face gaps in the ability to acquire federally-enforceable potential to emit limits due to delays in state adoption or EPA approval of programs or in their implementation. In order to ensure that such gaps did not create adverse consequences for states or for sources, on January 25, 1995, EPA issued a memo announcing a transition policy for a period extending until January 25, 1997. Under this policy, exclusionary rules and general permits could be used to create simple, streamlined means to ensure that these sources with actual emissions below 50% of major source thresholds would not be considered major sources for the transition period. EPA extended the transition period in subsequent memos, but made clear that the transition period would not be extended past the December 31, 2000, expiration date of the EPA transition policy that was given in the final transition policy memo.

On April 24, 1997, the board adopted an exclusionary general permit program (9VAC5-500, Exclusionary General Permit for Federal Operating Permit Program) to implement that EPA transition policy. By the December 31, 2000, expiration date of the EPA transition policy, all sources in Virginia that had obtained exclusionary general permits under that program had been issued state operating permits with federally enforceable emission limits and were no longer subject to applicability as major sources under the federal operating permit program. And, as of that date, 9VAC5-500 conflicted with federal and state regulatory requirements that all major sources (with respect to their potential to emit) apply for and obtain federal operating permits. The purpose of this amendment to repeal 9VAC5-500 is to resolve that conflict and remove the provisions of an unusable permit program that is no longer needed to protect the health, welfare, and safety of the public.

Rationale for Using Fast-Track Process: As of December 31, 2000, no more sources with exclusionary general permits existed and the department had the capability to issue sufficient permits with federally enforceable emission limits under the new source review permit programs or the state operating permit program to meet any affected source's need to be excluded from the federal operating permit program. Because no sources exist with exclusionary general permits under 9VAC5-500 and applicability under an exclusionary general permit will no longer protect a source from applicability under the federal operating permit programs, there is no stakeholder group that is likely to object to repeal of the regulation.

Substance: 9VAC5-500, Exclusionary General Permit for Federal Operating Permit Program, is repealed in its entirety. The repeal of this chapter does not affect the provisions of the federal operating permit program (9VAC5-80, Articles 1, 2, 3, and 4).

Issues: The primary advantage to the public is the removal of unusable and conflicting regulatory requirements, which improves the public's ability to understand and comply with regulatory requirements. There are no disadvantages to the public.

The primary advantage to the department is the removal of regulations that are no longer necessary. There are no disadvantages to the department

Department of Planning and Budget's Economic Impact Analysis:

Summary of the Proposed Amendments to Regulation. This regulation establishes procedures for facility owners to obtain authority to operate under a general permit in order to avoid the necessity of obtaining a permit required under Title V of the Clean Air Act. The Air Pollution Control Board proposes to repeal this regulation because the U.S. Environmental Protection Agency (EPA) policy under which this regulation operated has expired and the regulation is no longer applicable.

Result of Analysis. The benefits likely exceed the costs for all proposed changes.

Estimated Economic Impact. Since the regulation is no longer applicable, repealing it will have no impact beyond reducing potential confusion amongst the public.

Businesses and Entities Affected. Since the regulation is no longer applicable, repealing it will not affect businesses or other entities.

Localities Particularly Affected. The proposed repealing of this regulation will not disproportionately affect particular localities.

Projected Impact on Employment. The proposed repealing of this regulation will not affect employment.

Effects on the Use and Value of Private Property. The proposed repealing of this regulation will not affect the use and value of private property.

Small Businesses: Costs and Other Effects. The proposed repealing of this regulation will not affect small businesses.

Small Businesses: Alternative Method that Minimizes Adverse Impact. The proposed repealing of this regulation will not produce an adverse impact on small businesses.

Real Estate Development Costs. The proposed repealing of this regulation will not affect real estate development costs.

Legal Mandate. The Department of Planning and Budget (DPB) has analyzed the economic impact of this proposed regulation in accordance with § 2.2-4007.04 of the Administrative Process Act and Executive Order Number 14 (10). Section 2.2-4007.04 requires that such economic impact analyses include, but need not be limited to, the projected number of businesses or other entities to whom the regulation would apply, the identity of any localities and types of businesses or other entities particularly affected, the projected number of persons and employment positions to be affected, the projected costs to affected businesses or entities to implement or comply with the regulation, and the impact on the use and value of private property. Further, if the proposed regulation has adverse effect on small businesses, § 2.2-4007.04 requires that such economic impact analyses include (i) an identification and estimate of the number of small businesses subject to the regulation; (ii) the projected reporting, recordkeeping, and other administrative costs required for small businesses to comply with the regulation, including the type of professional skills necessary for preparing required reports and other documents; (iii) a statement of the probable effect of the regulation on affected small businesses; and (iv) a description of any less intrusive or less costly alternative methods of achieving the purpose of the regulation. The analysis presented above represents DPB's best estimate of these economic impacts.

Agency's Response to Economic Impact Analysis: The department has reviewed the economic impact analysis prepared by the Department of Planning and Budget and has no comment.

Summary:

This action repeals in its entirety 9VAC5-500 because the U.S. Environmental Protection Agency policy under which the regulation operated has expired, rendering the regulation obsolete.

VA.R. Doc. No. R12-2934; Filed April 4, 2012, 10:06 a.m.

w –––––––––––––––––– w

STATE CORPORATION COMMISSION

REGISTRAR'S NOTICE: The State Corporation Commission is exempt from the Administrative Process Act in accordance with § 2.2-4002 A 2 of the Code of Virginia, which exempts courts, any agency of the Supreme Court, and any agency that by the Constitution is expressly granted any of the powers of a court of record.

Proposed Regulation

Title of Regulation: 14VAC5-41. Rules Governing Advertisement of Life Insurance and Annuities (amending 14VAC5-41-40).

Statutory Authority: §§ 12.1-13 and 38.2-223 of the Code of Virginia.

Public Hearing Information: A public hearing will be held upon request.

Public Comment Deadline: May 4, 2012.

Agency Contact: James Young, Manager Special Projects, Bureau of Insurance, Life and Health Division, State Corporation Commission, P.O. Box 1157, Richmond, VA 23218, telephone (804) 371-9612, FAX (804) 371-9944, or email james.young@scc.virginia.gov.

Summary:

The amendments clarify the disclosure language required for advertisements of certain life insurance policies and annuities.

AT RICHMOND, MARCH 30, 2012

COMMONWEALTH OF VIRGINIA, ex rel.

STATE CORPORATION COMMISSION

CASE NO. INS-2012-00044

Ex Parte: In the matter of

Amending the Rules Governing

Advertisement of Life Insurance

and Annuities

ORDER TO TAKE NOTICE

Section 12.1-13 of the Code of Virginia provides that the State Corporation Commission ("Commission") shall have the power to promulgate rules and regulations in the enforcement and administration of all laws within its jurisdiction, and § 38.2-223 of the Code of Virginia provides that the Commission may issue any rules and regulations necessary or appropriate for the administration and enforcement of Title 38.2 of the Code of Virginia.

The rules and regulations issued by the Commission pursuant to § 38.2-223 of the Code of Virginia are set forth in Title 14 of the Virginia Administrative Code.

The Bureau of Insurance ("Bureau") has submitted to the Commission a proposal to amend the Rules Governing Advertisment of Life Insurance and Annuities at Chapter 41 of Title 14 of the Virginia Administrative Code, specifically set forth at 14 VAC 5-41-40, General disclosure requirements.

A request for clarification of the amendments to subsection H of 14 VAC 5-41-40 was made by a group of life insurance companies that do business primarily in the final expenses market. After the Bureau promulgated new rules at 14 VAC 5-41, which became effective July 1, 2011, this group of companies questioned the applicability of the disclosure language in subsection H to certain policies, as well as the length of required disclosure, and asked the Bureau for clarification. The Bureau has revised the language to meet the Bureau's goals as well as to address the concerns of these companies.

NOW THE COMMISSION is of the opinion that amendments to Section 40 of Chapter 41 of Title 14 of the Virginia Administrative Code should be considered for adoption.

Accordingly, IT IS ORDERED THAT:

(1) The proposal to amend Chapter 41 of Title 14 of the Virginia Administrative Code, specifically 14 VAC 5-41-40, General disclosure requirements, is attached hereto and made a part hereof.

(2) All interested persons who desire to comment in support of or in opposition to, or request a hearing to oppose amending Section 40 in Chapter 41 of Title 14 of the Virginia Administrative Code, shall file such comments or hearing request on or before May 4, 2012, with Joel H. Peck, Clerk, State Corporation Commission, c/o Document Control Center, P.O. Box 2118, Richmond, Virginia 23218. Interested persons desiring to submit comments electronically may do so by following the instructions at the Commission's website: http://www.scc.virginia.gov/caseinfo.htm. All comments shall refer to Case No. INS-2012-00044.

(3) If no written request for a hearing on the proposal to amend 14 VAC 5-41-40 is received on or before May 4, 2012, the Commission, upon consideration of any comments submitted in support of or in opposition to the proposal, may amend 14 VAC 5-41-40.

(4) AN ATTESTED COPY hereof, together with a copy of the proposal to amend rules, shall be sent by the Clerk of the Commission to the Bureau of Insurance in care of Deputy Commissioner Althelia P. Battle, who forthwith shall give further notice of the proposal to amend rules by mailing a copy of this Order, together with the proposal, to all companies licensed by the Commission to write life insurance or annuities in the Commonwealth of Virginia, as well as all interested parties.

(5) The Commission's Division of Information Resources forthwith shall cause a copy of this Order, together with the proposal to amend rules, to be forwarded to the Virginia Registrar of Regulations for appropriate publication in the Virginia Register of Regulations.

(6) The Commission's Division of Information Resources shall make available this Order and the attached proposed amendments to the rules on the Commission's website: http://www.scc.virginia.gov/case.

(7) The Bureau of Insurance shall file with the Clerk of the Commission an affidavit of compliance with the notice requirements of Ordering Paragraph (4) above.

14VAC5-41-40. General disclosure requirements.

A. The information required to be disclosed by this chapter shall not be minimized, rendered obscure, or presented in an ambiguous fashion or intermingled with the text of an advertisement so as to confuse or mislead.

B. If an advertisement uses the terms "nonmedical," "no medical examination required," or similar terms where issue is not guaranteed, these terms shall be accompanied by a further disclosure of equal prominence and juxtaposition to the effect that issuance of the policy may depend upon the answers to the health questions contained in the application.

C. An advertisement shall not contain figures, dollar amounts, or statistical information unless it accurately reflects recent and relevant facts. The source of any figures, dollar amounts, or statistics used in advertisements shall be identified therein.

D. An advertisement for a life insurance policy containing graded or modified benefits shall prominently display any limitation of benefits. If the premium is level and coverage decreases or increases with age or duration, that fact shall be commonly disclosed. An advertisement of or for a life insurance policy under which the death benefit varies with the length of time the policy has been in force shall accurately describe and clearly call attention to the amount of minimum death benefit under the policy.

E. Any advertisement that mentions or refers to universal life insurance premiums shall indicate that it is possible that coverage will expire when either no premiums are paid following the initial premium, or subsequent premiums are insufficient to continue coverage , if true.

F. An insurer or agent shall advise a prospective applicant who is considering replacing a policy that under the existing policy the period of time during which the existing insurer could contest the policy or deny coverage for death caused by suicide may have expired or may expire earlier than it will under the proposed policy.

G. An advertisement for life insurance or an annuity that is to be used to fund a preneed funeral contract shall disclose that fact.

H. An advertisement for of a life insurance policy

or an annuity in which the face amount or any part of the face amount

is based on the that will not fund a preneed funeral contract and that

includes a listing, summary, description, or comparison of actual or

estimated cost costs of funeral goods or services shall contain

the following disclosure:

"This is (life insurance or an annuity). This

(life insurance or annuity) does not specifically cover funeral goods or

services, and may not cover the entire cost of your funeral at the time of

your death. The beneficiary of this (life insurance or annuity) may use the

proceeds of this (life insurance or annuity) for any purpose, unless

otherwise directed. The face amount of this (life insurance or annuity) is

not guaranteed to increase at the same rate as the costs of a funeral increase."

VA.R. Doc. No. R12-3144; Filed April 2, 2012, 2:24 p.m.

Title of Regulation: 14VAC5-300. Rules Governing Credit for Reinsurance (amending 14VAC5-300-10, 14VAC5-300-30, 14VAC5-300-40, 14VAC5-300-60, 14VAC5-300-70, 14VAC5-300-80, 14VAC5-300-90, 14VAC5-300-100, 14VAC5-300-110, 14VAC5-300-120, 14VAC5-300-130, 14VAC5-300-140, 14VAC5-300-150, 14VAC5-300-160; adding 14VAC5-300-95, 14VAC5-300-170; repealing 14VAC5-300-20, 14VAC5-300-50).

Statutory Authority: §§ 12.1-13 and 38.2-223 of the Code of Virginia.

Public Hearing Information: A public hearing will be held upon request.

Public Comment Deadline: June 22, 2012.

Agency Contact: Raquel Pino-Moreno, Principal Insurance Analyst, Bureau of Insurance, State Corporation Commission, P.O. Box 1157, Richmond, VA 23218, telephone (804) 371-9499, FAX (804) 371-9511, or email raquel.pino-moreno@scc.virginia.gov.

Summary:

The proposed amendments incorporate revisions made by the National Association of Insurance Commissioners (NAIC) to its Credit for Reinsurance Model Regulation. The revisions provide the State Corporation Commission with the authority to: (i) certify reinsurers or to recognize the certification issued by another NAIC-accredited state; (ii) evaluate a reinsurer that applies for certification and to assign a rating based on that evaluation; (iii) require that certified reinsurers post collateral in an amount that corresponds with its assigned rating, in order for a United States ceding insurer to be allowed full credit for the reinsurance ceded; (iv) evaluate a non-United States jurisdiction in order to determine if it is a "qualified jurisdiction" or choose to defer to an NAIC list of recommended qualified jurisdictions; and (v) require ceding insurers to take steps to manage their concentration risk and to diversify their reinsurance program.

AT RICHMOND, APRIL 3, 2012

COMMONWEALTH OF VIRGINIA, ex rel.

STATE CORPORATION COMMISSION

CASE NO. INS-2012-00058

Ex Parte: In the matter of

Adopting Revisions to the Rules

Governing Credit for Reinsurance

ORDER TO TAKE NOTICE

Section 12.1-13 of the Code of Virginia provides that the State Corporation Commission ("Commission") shall have the power to promulgate rules and regulations in the enforcement and administration of all laws within its jurisdiction, and § 38.2-223 of the Code of Virginia provides that the Commission may issue any rules and regulations necessary or appropriate for the administration and enforcement of Title 38.2 of the Code of Virginia.

The rules and regulations issued by the Commission pursuant to § 38.2-223 of the Code of Virginia are set forth in Title 14 of the Virginia Administrative Code. A copy may also be found at the Commission's website: http://www.scc.virginia.gov/case.

The Bureau of Insurance ("Bureau") has submitted to the Commission proposed revisions to rules set forth in Chapter 300 of Title 14 of the Virginia Administrative Code entitled Rules Governing Credit For Reinsurance, which amend the Rules at 14 VAC 5-300-10, 14 VAC 5-300-30, 14 VAC 5-300-40, 14 VAC 5-300-60 through 14 VAC 5-300-90, and 14 VAC 5-300-100 through 14 VAC 5-300-160; adopt new Rules at 14 VAC 5-300-95 and 14 VAC 5-300-170; and repeal the Rules at 14 VAC 5-300-20 and 14 VAC 5-300-50 ("Rules").

The proposed revisions to the regulations are necessary due to the passage of House Bill 1139 during the 2012 General Assembly Session, which amends and reenacts §§ 38.2-1316.1, 38.2-1316.2, 38.2-1316.4, and 38.2-1316.8; and repeals §§ 38.2-1316.3, 38.2-1316.5, and 38.2‑1316.6 of the Code Virginia, effective July 1, 2012. The proposed revisions incorporate the revisions made by the National Association of Insurance Commissioners ("NAIC") to its Credit for Reinsurance Model Regulation, and provides the Commission with the authority to (i) certify reinsurers or to recognize the certification issued by another NAIC-accredited state, (ii) evaluate a reinsurer that applies for certification and assign a rating based on that evaluation, (iii) require that certified reinsurers post collateral in an amount that corresponds with its assigned rating in order for a United States ceding insurer to be allowed full credit for the reinsurance ceded, and (iv) require ceding insurers to take steps to manage their concentration risk and to diversify their reinsurance programs.

NOW THE COMMISSION is of the opinion that the proposed revisions submitted by the Bureau amending the Rules at 14 VAC 5-300-10, 14 VAC 5-300-30, 14 VAC 5-300-40, 14 VAC 5-300-60 through 14 VAC 5-300-90, and 14 VAC 5-300-100 through 14 VAC 5-300-160, adopting new Rules at 14 VAC 5-300-95 and 14 VAC-300-170, and repealing the Rules at 14 VAC 5-300-20 and 14 VAC 5-300-50, should be considered for adoption with an effective date of January 1, 2013.

Accordingly, IT IS ORDERED THAT:

(1) The proposed revisions to Rules Governing Credit For Reinsurance, which amend the Rules at 14 VAC 5-300-10, 14 VAC 5-300-30, 14 VAC 5-300-40, 14 VAC 5-300-60 through 14 VAC 5-300-90, and 14 VAC 5-300-100 through 14 VAC 5-300-160, adopt new Rules at 14 VAC 5-300-95 and 14 VAC-300-170, and repeal the Rules at 14 VAC 5-300-20 and 14 VAC 5-300-50 be attached and be made a part hereof.

(2) All interested persons who desire to comment in support of or in opposition to, or to request a hearing to oppose the adoption of the proposed new rules shall file such comments or hearing request on or before June 22, 2012, in writing, with Joel H. Peck, Clerk, State Corporation Commission, c/o Document Control Center, P.O. Box 2118, Richmond, Virginia 23218, and shall refer to Case No. INS-2012-00058. Interested persons desiring to submit comments electronically may do so by following the instructions available at the Commission's website: http://www.scc.virginia.gov/case.

(3) If no written request for a hearing on the proposed new rules is filed on or before June 22, 2012, the Commission, upon consideration of any comments submitted in support of or in opposition to the proposed revisions to the Rules, may adopt the revised Rules.

(4) The Commission's Division of Information Resources forthwith shall cause a copy of this Order, together with the proposed revisions to the Rules, to be forwarded to the Virginia Registrar of Regulations for appropriate publication in the Virginia Register of Regulations and shall make available this Order and the attached proposed revisions to the Rules on the Commission's website: http://www.scc.virginia.gov/case.

(5) AN ATTESTED COPY hereof, together with a copy of the proposed revised Rules, shall be sent by the Clerk of the Commission to the Bureau in care of Deputy Commissioner Douglas C. Stolte, who forthwith shall give further notice of the proposed adoption of the revised Rules by mailing a copy of this Order, together with the proposed revised Rules, to all licensed insurers, burial societies, fraternal benefit societies, health services plans, risk retention groups, home protection companies, joint underwriting associations, group self-insurance pools, and group self-insurance associations licensed by the Commission, qualified reinsurers and certain interested parties designated by the Bureau.

(6) The Bureau shall file with the Clerk of the Commission an affidavit of compliance with the notice requirements of Ordering Paragraph (5) above.

14VAC5-300-10. Purpose.

The purpose of this chapter (14VAC5-300-10 et seq.) is

to set forth rules and procedural requirements which the Commission commission

has determined are necessary to carry out the provisions of Article 3.1 (§

38.2-1316.1 et seq.) of Chapter 13 of Title 38.2 of the Code of Virginia.

14VAC5-300-20. Severability. (Repealed.)

If any provision of this chapter or its application to any

person or circumstance, is held invalid, such determination shall not affect

other provisions or applications of this chapter which can be given effect

without the invalid provision or application, and to that end the provisions of

this chapter are severable.

14VAC5-300-30. Applicability and scope.

This chapter (14VAC5-300-10 et seq.) shall apply to

all insurers taking credit for reinsurance under the provisions of Article 3.1

(§ 38.2-1316.1 et seq.) of Chapter 13 of Title 38.2 of the Code of Virginia.

14VAC5-300-40. Definitions.

For purposes of The following words and terms when

used in this chapter (14VAC5-300-10 et seq.) shall have the

following meanings unless the context clearly indicates otherwise:

"The Act" means the provisions concerning reinsurance set forth in Article 3.1 (§ 38.2-1316.1 et seq.) of Chapter 13 of Title 38.2 of the Code of Virginia.

"Accredited reinsurer" has the meaning set forth

in § 38.2-1316.1 of the Code of Virginia.

"Accredited state" means a state in which the

supervising insurance official, state insurance department or regulatory agency

is accredited by the National Association of Insurance Commissioners (NAIC)

with respect to compliance with the NAIC Policy Statement on Financial Regulation

Standards.

"Audited financial report" means and includes

those items specified in 14VAC5-270-60 of this title, "Rules Governing

Annual Audited Financial Reports."

"Beneficiary" means the entity for whose sole

benefit the trust described in 14VAC5-300-120 of this chapter, or the

letter of credit described in 14VAC5-300-130 of this chapter, has been

established and any successor of the beneficiary by operation of law,

including, without limitation, any receiver, conservator, rehabilitator or

liquidator.

"Certified reinsurer" has the meaning set forth in § 38.2-1316.1 of the Code of Virginia.

"Credit" has the meaning defined in §

38.2-1316.1 of the Code of Virginia.

"Grantor" means the entity that has established a

trust for the sole benefit of the beneficiary. However, when such a trust is

established in conjunction with a reinsurance agreement that qualifies for

credit under 14VAC5-300-120 of this chapter, the grantor shall not be an

assuming insurer for which credit can be taken under § 38.2-1316.2 or §

38.2-1316.3 of the Code of Virginia.

"Mortgage-related security" means an obligation that is rated AA or higher (or the equivalent) by a securities rating agency recognized by the Securities Valuation Office of the NAIC and that either:

1. Represents ownership of one or more promissory notes or certificates of interest or participation in the notes (including any rights designed to assure servicing of, or the receipt or timeliness of receipt by the holders of the notes, certificates, or participation of amounts payable under, the notes, certificates or participation), that:

a. Are directly secured by a first lien on a single parcel of real estate, including stock allocated to a dwelling unit in a residential cooperative housing corporation, upon which is located a dwelling or mixed residential and commercial structure, or on a residential manufactured home as defined in 42 USCA § 5402(6), whether the manufactured home is considered real or personal property under the laws of the state in which it is located; and

b. Were originated by a savings and loan association, savings bank, commercial bank, credit union, insurance company, or similar institution that is supervised and examined by a federal or state housing authority, or by a mortgagee approved by the Secretary of Housing and Urban Development pursuant to 12 USCA §§ 1709 and 1715-b, or, where the notes involve a lien on the manufactured home, by an institution or by a financial institution approved for insurance by the Secretary of Housing and Urban Development pursuant to 12 USCA § 1703; or

2. Is secured by one or more promissory notes or certificates of deposit or participations in the notes (with or without recourse to the insurer of the notes) and, by its terms, provides for payments of principal in relation to payments, or reasonable projections of payments, or notes meeting the requirements of items 1 a and b of this definition.

"NAIC" means the National Association of Insurance Commissioners.

"Obligations", as used in 14VAC5-300-120 B 6 of

this chapter 14VAC5-300-120 A 11, means:

1. Reinsured losses and allocated loss expense expenses

paid by the ceding company, but not recovered from the assuming insurer;

2. Reserves for reinsured losses reported and outstanding;

3. Reserves for reinsured losses incurred but not reported; and

4. Reserves for allocated reinsured loss expenses and unearned premiums.

"Promissory note" means, when used in connection with a manufactured home, a loan, advance or credit sale as evidenced by a retail installment sales contract or other instrument.

"Qualified United States financial institutions" has the meanings set forth in § 38.2-1316.1 of the Code of Virginia.

"Statutory financial statement" means financial

statements filed on either a quarterly or annual basis with the supervising

insurance official, insurance department or insurance regulatory agency of the

assuming insurer's state of domicile or, in the case of an alien assuming

insurer, with the state through which it is entered and in which it is licensed

to transact insurance or reinsurance. Any statutory financial statement

required under this chapter shall be filed in accordance with the filing dates

prescribed for the financial statements filed by licensed insurers pursuant to

§§ 38.2-1300 and 38.2-1301 of the Code of Virginia.

"Substantially similar" standards means credit

for reinsurance standards which the Commission determines equal or exceed the

standards of the Act and this chapter (14VAC5-300-10 et seq.). An insurer

licensed and domiciled, or entered through and licensed, in an accredited state

is deemed to be subject to substantially similar standards for purposes of the

Act and this chapter.

"Surplus to policyholders" (i) when applied to a

domestic or foreign assuming insurer, has the meaning set forth in § 38.2-100

of the Code of Virginia, and (ii), when applied to an alien assuming insurer,

means "trusteed surplus" as defined in § 38.2-1031 of the Code

of Virginia. In both instances as used in this chapter, the calculation and

verification of such surplus shall be subject to the provisions of Title 38.2

of the Code of Virginia pertaining to admitted assets, investments, reserve

requirements and other liabilities.

14VAC5-300-50. Credit for reinsurance generally. (Repealed.)

A. Except for those credits or reductions in liability

allowed pursuant to § 38.2-1316.4 of the Act, a ceding insurer shall not

receive reserve credits for reinsurance unless the assuming insurer meets

certain financial and licensing requirements established by §§ 38.2-1316.2 and

38.2-1316.3 of the Act. The following subdivisions of this section and

14VAC5-300-60 through 14VAC5-300-90 of this chapter set forth requirements for

such assuming insurers.

B. The Act also contains examination and jurisdiction